The Investment Association, trade body and industry voice for investment managers in the UK, recently published updated governance and disclosure guidelines for housing associations seeking funding from capital markets (the Guidelines).

The Guidelines set out long-term investors’ expectations regarding public disclosures by housing associations who issue debt securities or bonds. The Guidelines reiterate and expand the previous version, which were published by the Investment Association in 2017.

Transparency is a commercial and legal requirement for the successful functioning of the capital markets. The Guidelines point out that greater transparency and visibility on how housing associations are performing and how they are governed, through publicly known and accessible information channels, will result in greater investor confidence, more stable pricing in the secondary markets, and a broader base of parties keen to invest.

The Guidelines focus not only on the content of disclosures but also timeliness and accessibility of communications. Issuers of debt securities are subject to legal obligations under the UK Market Abuse Regulation to avoid making improper disclosures of inside information, for example to other issuers or to certain investors ahead of others. Investors who have received inside information could be legally barred from trading until the relevant information is made public. To avoid such situations, the Guidelines recommend clear, consistent channels of communication, which should include the issuer using a Regulatory Information Service (e.g. RNS) for disclosure of material information and maintaining a dedicated public “investor relations” page on its website.

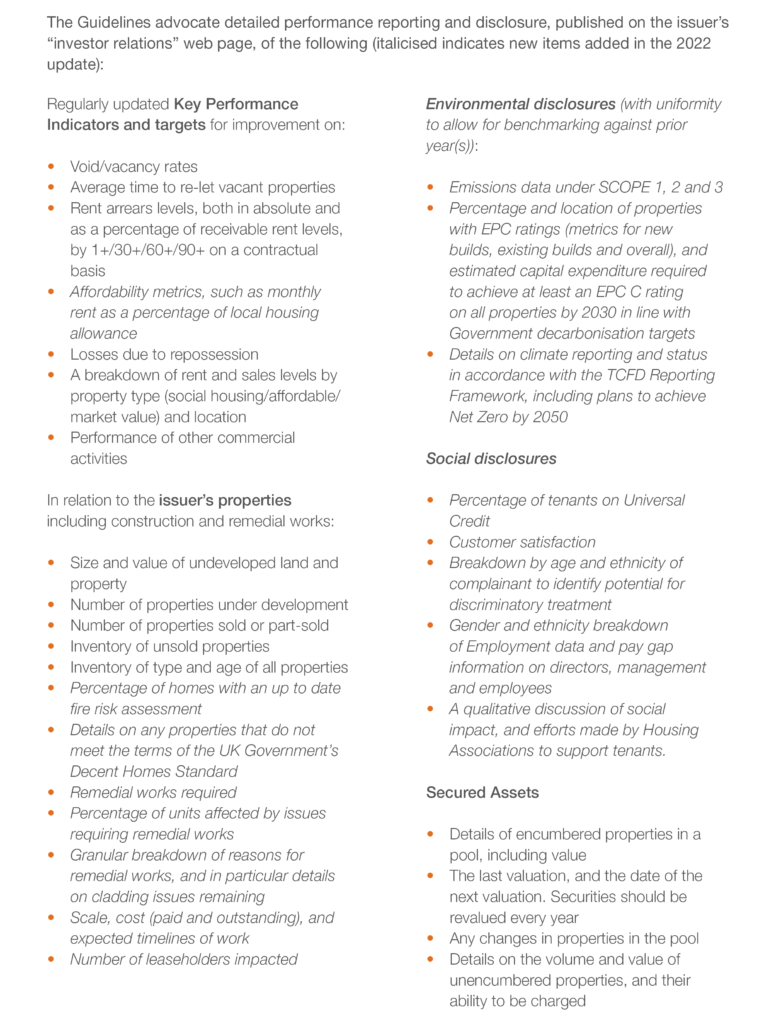

Introducing and maintaining the required level of disclosure represents a significant challenge. The Guidelines include a daunting list of performance reporting and secured asset disclosures at a granular level (see box below). Much of this information should be available to issuers but is not routinely published in an easily and publicly accessible manner. The Guidelines state that the FCA Handbook’s Disclosure and Transparency Rules are market standard, inferring that they should be adhered to even though they are not legally applicable to social housing issuers. Also of note are the tighter timeframes advocated for publication of the annual report and accounts (within 3 months of financial year end) and half yearly unaudited accounts (within 6 weeks of the end of the first 6 months of each financial year). Such timeframes are much shorter than typical contractual requirements under capital markets documentation and also shorter than the statutory and regulatory requirements. The Guidelines recommend that these documents remain available for ten years on the issuer’s website.

The updated Guidelines are also a clear indication that investors are keen to track the impact on issuers of specific recent challenges faced by the sector. For example, the following are all additions to their list of desired public disclosures: affordability metrics, fire risk assessments and cladding issues, compliance with the Decent Homes Standard, remedial works and gender pay gap data. Governance requirements have been expanded to include diversity considerations and policies. Modern slavery documents should be available or signposted on the issuer’s investor relations webpage.

Unsurprisingly, the Guidelines are consistent with the increasing global imperative of greater transparency on environmental, governance and social (ESG) matters. Investors themselves are now under significant legal duties, as well as societal pressure, to disclose information about the sustainability of their investments. In order to comply, they in turn need the relevant information from the businesses and assets in which they invest. Investors expect housing associations to be aware of both regulatory obligations and investor expectations to disclose key environmental and social indicators. The Guidelines ambitiously recommend that issuers report in line with the Task Force on Climate Related Financial Disclosures (TCFD) Reporting Framework and that they publish scope 1, 2 and 3 emissions data. The Guidelines point to the Good Economy Sustainability Reporting Standard (SRS) as a possible established format in which to provide ESG-related information, and many housing associations have already adopted the SRS and published reports against its metrics. However, ESG reporting is an evolving landscape and it must be recognised that the SRS currently represents an aspirational level of disclosure. Housing associations may increasingly need to consider the level and format of information to be provided, particularly where data does not exist yet or cannot be fully compiled.

It is clear that achieving the recommended level of transparency will require significant thought and appropriate resource from social housing bond issuers. In some respects, the Guidelines constitute a “gold standard” of disclosure, but in fact most of the updated recommendations are an orderly and sensible extension of current Guidelines. Issuers will recognise the direction of travel towards greater transparency and consistency of reporting, and greater scrutiny of a widening set of performance metrics, by funders and investors.

Please contact Alice Overton or Julian Barker with any queries.